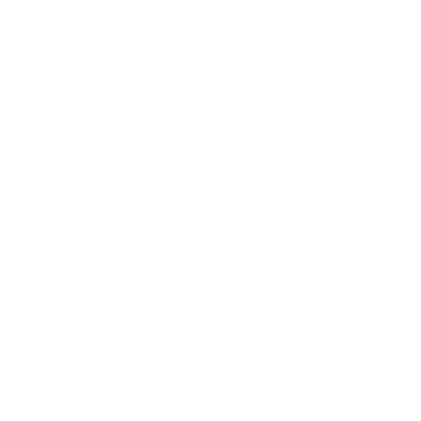

Our software powers your business ecosystem.

We purpose built our software for HVAC, Elevator and Service Industries. Book a demo today to see how we can take your business to the next level.

Why Total Service

With 30 years of experience in the industry, we have a deep understanding of HVAC, Elevator and service organizations. We have utilized this knowledge to build a best in class All-in-One software solution that is purpose built to empower the HVAC Elevator and service organizations.

Project Management

Gain real-time access to crucial information about the customer, inventory, purchase orders, payables, and equipment to make profitable judgments.

Manage Financials

Manage your business by automating all repetitive operations and transferring data logically from the point of entry all the way through to finalized documents without requiring any data to be entered again.

Performance Dashboards

Our performance dashboard enables businesses to track key metrics and make data-driven decisions to improve their operations and achieve their goals.

Dispatch

Effectively manage and schedule your field technicians, allowing for improved productivity and customer service.

Payroll Systems

We have extensive labor costing tools available, regardless of whether you choose to use payroll or not. Additionally, federal and state taxes, union wages, deductions and job specific wages are fully supported.

Job Costing

We help businesses understand the costs associated with specific projects or jobs, making it easier to track expenses and optimize pricing strategies.